I said that: Stock market still has a long way to go to get back

This is what I said just three posts ago—well almost.

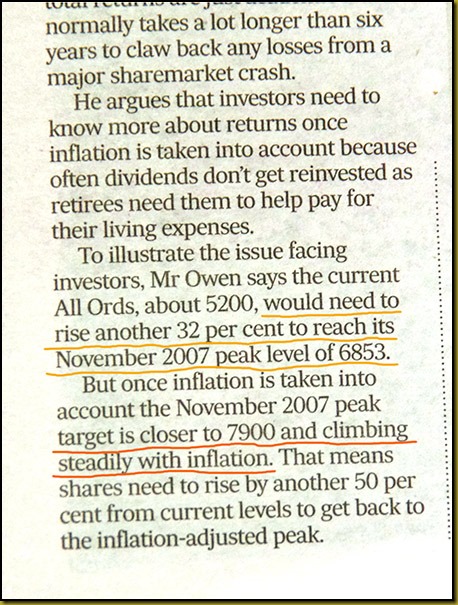

This snippet comes from the Market Monitor column by Phillip Baker which can be found at the bottom of page 27 in the Smart Money section of the Weekend Review. The article is titled “Gains lose lustre in the cold light of inflation”.

In my posting I pointed out that all this carry on about the Australian stock market reaching its highest levels since 2008 is a bit misleading. While this may be true, the market is still a good 30 percent away from the peak before the Global Financial Crisis (GFC).

In his column (shown) Phillip Baker makes the point that when you index the pre-GFC market peak with the rate of inflation it works out that the market needs to get to 7,900 in order to be at the relative same peak it was at before the GFC.

Based on this the market is actually a whopping 50 percent behind where it would have been if the GFC had not happened.

So the impacts of the GFC are far from remedied, and on top of this the resources markets are struggling, the Reserve Bank can’t get the dollar down despite all the rate drops (every one of which financially hurts all retirees), there is the possibility of a real estate bubble that has a lot of analysts worried, the WA government is further in debt than any previous WA government has ever been, and the unemployment rate is going up every quarter.

In a nutshell: The economy is far from ‘back on track’ as the ex-treasure would have us believe.