What to expect for the Australian economy in 2013

Okay. I have just finished my third pass through Saturday’s ‘Australian Financial Review’ (AFR) which carries the banner “Financial Review: Christmas Bumper Issue”. I think I have absorbed all the high points of this 88 page edition—not that the ‘high’ points are especially high.

I will give you my bottom line at the start.

The bottom line is: Based on the reporting in the AFR we can expect the economy for 2013 to be much like like the second half of 2012.

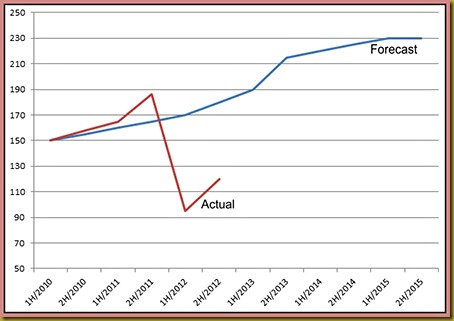

But the mining industry peaked four years early in the first half of 2012 and the cost per tonne of iron ore did not get close to $230; it hit $186 before plummeting below $100 per tonne in mid-2102 and is now floating very cautiously back to around $120 per tonne.

Just in case the numbers in the text don’t make it clear what happened here I have whipped up a very quick graph. The blue line was how the boom was supposed to go with prices peaking in 2015. The red line is what happened showing the peak, unless we have another one, in the time between the 2011 and 2012.

This very early and totally unexpected peaking of the mining industry caught both federal and state governments totally off guard. As a result the federal government has now finally confessed it has no hope of bringing the country’s budget back into credit. In fact Australia is likely to end the year around $8 billion in the poo. On top of this two additional states have announced they too will slip into the red zone this financial year; being New South Wales and Western Australia. That will then mean four of the seven states are underwater with their finances.

The second thing that has gone wrong is our persistently high dollar. This is causing all kinds of grief and despite five rate reduction attempts by the Reserve Bank in the the last 18 months to try and force the dollar down it remains at unexplainable levels. With the last two cash rate reductions the dollar actually went up—which was totally not expected to happen.

The overpriced Australian dollar is adversely impacting internal manufacturing and our exports are suffering. Over the last three years a massive seven percent of manufacturing businesses have stopped trading for one reason or another.

The third general issue Australia now has is that our cost of labour is the highest in the world. A huge contributing factor to this is that, for whatever reason, and I have no idea at all how they measure this, over the last five years our productivity has fallen by 30 percent.

What this means is that the amount of useful ‘work’ being done by ‘workers’ for the money they are paid has dropped by almost a third. This then effectively pushes up the cost of labour (because you need 30 percent more labour to get the same amount of work done). So not only are our base wages high in comparison to most other countries, we—as a workforce—only do about 70 percent of the work required in order to earn this money.

The fourth issue is that the cost of government is increasing at a fast rate. Never before has the cost of government increased so dramatically over such a short period. The government blames this on big ticket items like the boat people, natural disasters, the cost of ensuring Australia got through the GFC, taking action on climate change, and financial aid to ailing industries (such as the car industry). Whatever the reason the cost of government per tax payer has skyrocketed over the last five years.

These four contributing issues put Australia in a worrisome position for the next few years.

The federal government is so concerned about how fast they are losing money because of lost income from tax receipts (due mainly to the mining boom bust) and the cost of government that they are looking at ways of getting more money coming in. They have three main plans they like at this stage: increase the GST rate from 10 percent to 12.5 percent; bring exempted ‘essentials’ into the GST net (e.g., food, baby products, etc.,); or introduce a currency exchange levy of around 20 percent. Interestingly, at this stage anyway, there does not seem to be any mention of increasing the general income tax rates. But you can bet this will bob up sooner or later.

This last option is interesting and is intended as a way for the government to make money out of all the on-line buying Australians are apparently doing overseas. A currency exchange levy (or currently conversion tax) would mean that banks would then be required by the government to charge a levy for all credit card transactions where the source purchase was being done in another currency. So, if you bought a camera lens from the USA that cost US$500 the cost would first be converted to Australian dollars, which at and exchange rate of $1.05 would make it AUS$476.19. Then 20 percent is added to this to get the final price, making it AUS$571.43. This is what would appear on your credit card statement.

A currency conversion tax has two ‘positive’ outcomes. All oversees Internet purchases would make money for the government. But it would maybe also get people to buy from Australia instead; in order to avoid the currency conversion tax. Obviously this would only work where the 20 percent conversion tax then made the item more expensive to buy overseas than it did to buy it locally.

What about real estate? The expert opinion for real estate is that it will remain flat through 2013. Investors are not expected back into the real estate market in 2013. The main people buying houses in 2013 will be owner/occupiers.

Anyone have any thoughts they want to add?