Problems looming for baby boomers downsizing?

Most weekends I get the Australian Financial Review (AFR) Weekend Edition. I am not sure why. Lately it is usually a relatively depressing read.

A theme spread across three pages in this weekend’s AFR is that the baby boomers are going to be in for some disappointment and stress when it comes to selling their “big” homes to downsize.

For those that have not been paying attention, baby boomers are those of us born in the heady years just after World War II—sometime between 1946 and 1964. Apparently us boomers have enjoyed long-term economic boom times like no generation before or any generation after—I say again “apparently”.

Well it seems the looming concern is that as us baby boomers start to want to sell our “big” homes and downsize we are going to impact the housing market; in a bad way. The thinking is that as this flood of houses hits the market that an already loaded market will become overloaded with properties. On top of this we will all be expecting to get more for our “big” houses than they are worth in this nervous post-GFC era.

On top of this the current generations don’t have the funds or job security to purchase these properties; plus they are less interested in “big” houses than us baby boomers were. New buyers are not interested in ‘formal’ dining rooms or front lounge rooms, and in many cases the ‘games room’ is gone (possibly replaced with a somewhat smaller theatre room). The average free standing house being built now is around 30 percent smaller than in the mid-1980s and the average suburban block of land is 45 percent smaller (i.e., very close to half the size).

So—the thinking is—that this all adds up to lots of overpriced houses on the market that nobody is buying, which, in a supply and demand versus price market means that something rather unwanted is likely to happen. Smaller properties that the baby boomers are keen to move into will go up in price; but—and this is the gotcha—they won’t get the money they were expecting to get for the property they are selling; if they can sell it.

A collateral effect of the smaller properties going up due to demand by the boomers is that they will be pushed further out of the price range of the current generations of home buyers.

When is this likely to start happening? Assuming the various writers in the AFR have it right then we are just starting into the leading edge of this scenario now and the problem will gradually heat up over the next five years and peak around 2018 through 2020.

The recommendation put forward is that boomers looking to downsize in the next few years should review what options they have to buy their downsized house now.

While all this seems to make sense I am not so sure of the outcomes. I plan to try and keep on top of this. I am a baby boomer and I am looking at downsizing options in the near future.

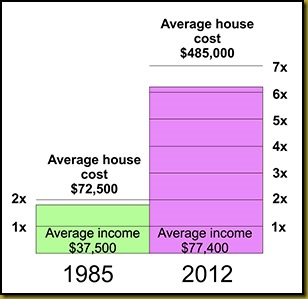

Income figures were pulled from the Australian Bureau of Statistics site. The 2012 figures are for November 2012. House price figures are from the REIWA chart “Perth House Prices 1974 – 2012” (here).

Another interesting observation is that while the average income has done only slightly better than double from 1985 to 2012, the average cost of a house has increased by 13 times. This almost seem impossible. It certainly doesn’t seem right.