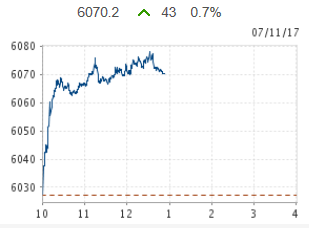

All Ordinaries index FINALLY breaks the 6,000 line

Three years later than it was originally forecast to, the Australia 'All Ordinaries' stock index has finally got over the 6,000 marker.

I know that there are a number of respected forecasters suggesting this is an aberration and that the index will likely fall back below this mark before Xmas; but just the fact it has finally made it 6,000 is great for those of us facing retirement in the not-too-distant future.

With most superannuation funds you will find that somewhere around fifty percent of the fund's investment will be in Australian stocks (with another 15 to 20 percent in overseas stocks). So everybody out there who has superannuation--which will be everybody who has a job or who has had a job--should be throwing a 6,000 Index Party about now.

On the downside, even at 6,000 the All Ordinaries index is still a whopping 828 points away from getting back to where it was before the Global Financial Crisis (GFC) hit us back in 2007/2008. So, it has taken almost ten long years for the Australian index to claw back this far; and based on the current climb rate we can't expect to see the index finally get back to its pre-GFC level until about mid-2019. That's assuming we don't go to war with anyone in the meantime and the oft talked about 'second GFC ripple' does not come true.

I will just also point out that almost every other market index in the world made it back to their pre-GFC levels three or four years ago. I often wonder how it is that in that country that apparently made it through the GFC better than all the others--so the Labor government told us over and over at the time--has such an under-performing share market?